Meezan Savings

Plans

As an individual, you may have many dreams including children’s education, a dream wedding for your beloved child, your spiritual journey to perform Hajj or a dream home for your family.

As an individual, you may have many dreams including children’s education, a dream wedding for your beloved child, your spiritual journey to perform Hajj or a dream home for your family.

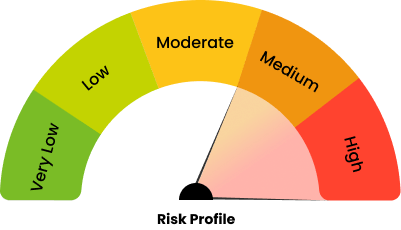

MFPF Home Builder Plan help you to plan for your dream home. With ease of regular investments and choice of allocation in accordance to your risk appetite.

Investment in Home Builder plan allows you to:

You can choose to invest in the following Allocation Plans:

| Plan | Shariah Compliant Equity Fund(s)/MIF Indicative Minimum Limits | Shariah Compliant MSF Indicative Minimum Limits |

|---|---|---|

| Aggressive Allocation Plan | 65% | 25% |

| Moderate Allocation Plan | 45% | 45% |

| Conservative Allocation Plan | 20% | 70% |

| Sr. No | Indicative Minimum percentage allocation invested in Collective Investment Scheme(s) | |||

|---|---|---|---|---|

| Equity Scheme(s) | Fixed Income/Money Market Scheme (s) | Risk of Principal Erosion | ||

| 1 | Aggressive Allocation Plan | 65% | 25% | Principal at High Risk |

| 2 | Moderate Allocation Plan | 45% | 45% | Principal at Medium Risk |

| 3 | Conservative Allocation Plan | 20% | 70% | Principal at Medium Risk |

| 4 | Very Conservative Allocation Plan | 0% | 100% | Principal at Medium Risk |

| Age Band | Takaful Benefit | Amount of Takaful Sum | Gross Rates |

| 18 – 25 | Death due to any cause | (Sum Covered – Balance Amount) Subject to Max of Rs. 5 Million per Investor. | 0.56 |

| 26 – 30 | 0.8 | ||

| 31 – 35 | 1.11 | ||

| 36 – 40 | 1.59 | ||

| 41 – 45 | 2.45 | ||

| 46 – 50 | 4.38 | ||

| 51 – 55 | 9.98 |

Supplementary Offering Documents: Click Here

*Takaful contributions are deducted from investor’s investment account maintained with Al Meezan and submitted to the Takaful operator at periodic frequency. Takaful is subject to underwriting. The AMC will not be responsible or liable for maintaining service levels and/or any delay in processing claims arising out of this facility. The Management Company, the Trustee and the underlying Fund shall not be held liable for honoring any Takaful claims.

Sum Covered – Balance Amount is subject to max of Rs. 5 Million per investor. Minimum age to enter Takaful Plan is 18 years and maximum age is 59 years.

Risk Disclosure: All investments in mutual fund are subject to market risks. Past performance is not necessarily indicative of the future results. Please read the Offering Document to understand the investment policies and the risks involved.